Trading activity along with a host of other factors determines the prices. However, it would be wrong to claim that both of these are exclusively related. Gold prices were rising even before the great recession of the early 2000s and peaked after the situation improved. However, the gold price did respond to the inflation resulting from the recession.

To conclude, the gold rate today has an important role in impacting the value of the U.S. dollar, the Indian rupee along with impacting the inflation or deflation in the country. Gold prices in India and the Indian rupee’s value are dependent on the U.S. dollar’s value in the international market. The gold rate in the market and its relation to the U.S. dollar is inversely proportional. If there is a rise in the U.S. dollar value, gold value decreases and vice versa. When expected or actual returns on bonds, equities, and real estate fall, the interest in gold investing can increase, driving up its price.

When RBI starts to buy greater quantity than it sells, the price increases as it will result in insufficient supply of gold and vice versa. Read on to find out more about why do gold prices differ across cities in India. So now you get to know how gold rates are calculated in India. The rate of gold on a particular day is based on the International gold rate on that day. Based on this theory the price should be the same across regions. Several factors contribute to different Gold price in the states of India.

For decades it has played that role, protecting investor assets through tough economic times. China, South Africa, the USA, Australia and Russia are significant players in gold mining. Though gold mining production has seen a lot of increase in the last ten years, from 2016 to 2018, it has barely moved. Now miners have to dig deeper, risking their health for a lesser amount of gold. All these factors lead to an increase in the cost of mining gold which results in inflated prices.

Inflation

Let’s understand the process of how the gold price is calculated and what determines gold prices in India. Gold has been among the most precious metals in the world and its value as a commodity has been increasing since the past decade. Before, in many countries including India, gold was symbolic of being rich and powerful. Even during the times of kings and kingdoms, the prosperity of that kingdom was directly proportional to how much gold the king owned. During times of economic uncertainty, as seen during times of economic recession, more people begin investing in gold because of its enduring value.

- And as the dollar gets weaker, they seek to invest in assets that maintain their value no matter how weak the dollar gets.

- Since gold prices are affected by many factors, it may not always be the case where a rise in gold prices automatically means, a decline in the fiat currency of the country.

- Because of this, it’s not so much gold supply as the limited amount of gold supply increases that affects gold prices.

Some media has alluded to the fact that our rapid diversification in last few years has resulted in this situation. This diversification into data-driven and IT based services compliments that nature of work in our core financial services business and has been ongoing for the last fifteen years. Amongst our various businesses, we are a stock brokerage company which services clients across the country and assists them in their investment decisions. It is under the regulatory oversight of SEBI as well as NSE and BSE which on a routine and ongoing basis audit our performance, books of account and other particulars.

Purchase Price of Gold

Although, remember the fluctuation in rupee-dollar rates makes no impact on gold rates denominated in dollars. Gold is a precious metal that is widely used as a store of value, an investment, and a hedge against inflation. Gold rates are affected by a variety of factors, including global supply and demand, interest rates, currency fluctuations, and geopolitical events. Let us understand global and domestic factors affecting gold prices.

There’s a real danger that the Fed could overshoot in its stimulus, creating trillions of dollars of money out of thin air and resulting in a hyperinflationary crisis. Such traders are called as Event Traders, they generally trade in huge quantities because the market’s volatility is very high during such times. Yes, making charges could be different for different designs and shops. This is something you need to ask the jeweller you are buying from. They usually range from 3-25% depending on whether it is mass-machine made jewellery or intricate handmade jewellery. For example, the making charges for machine-made chains can be as low as 3% while it’s much higher for temple collection jewellery.

When the yield of foreign investments is too low , then surplus countries prefer to invest in the local economy, often in real estate. Finally these investments in the local economy may also be investments in human capital; hence wages rise. Between 2009 and summer 2011 emerging markets continued their ascent but high oil prices and the weak housing market hampered the United States.

One should note that buying gold without a bill encourages gold smuggling and is a criminal act. 24 karat gold is also known as 999 gold and is the purest form of gold available in market in the form of gold coins and bars. Similarly, 22 karat gold is known as 916 gold and is generally used to make jewellery. The original state rate less the discount makes the difference in the price of gold. As in any trade or business, the higher you purchase the more you get it at the discounted price. If you are in a state that has a higher consumption of gold, the sellers naturally tend to import more quantity to meet the supply chain requirement.

· Geopolitical Factors:

It is believed by some economists that gold is a highly effective portfolio diversifier due to its low to negative correlation with all major asset classes. Still, as a rule, gold shows no statistically significant correlation with mainstream asset classes. According to a Bloomberg report, since the abandonment of the US Gold standard in 1971, global central banks have constantly been loading up their gold reserves. According to the World Gold Council, about 650 tonnes of gold was bought in total. This buying spree in 2019 was led by Turkey, followed closely by Russia, Poland and China.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorize your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.

You can sell your old gold jewellery without any constraints on the time period. However, you must check with the retailer about repurchase of old gold both for cash and exchange. Before gold bar and jewellery-makers add their production cost, gold bullion and jewellery are subjected to state taxes, such as GST. However, through the years, even after currencies were created that are in use today, gold serves many purposes in the economy which includes how it affects the value of these different currencies. Precious metals are rare metals that have a high economic value, such as gold, silver, and platinum. The value of gold is rooted in the history of human civilization, as the metal has remained a symbol of wealth for thousands of years.

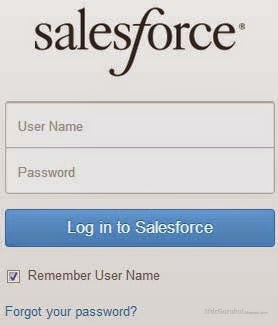

Open Free Trading Account Online with ICICIDIRECT

Often, investors and traders set on speculating what measures the governments and central banks are going to take and take appropriate measures based on that. As a result, they either accumulate loads of gold or let go of their gold, creating a temporary imbalance in the market. While urban India has other interesting investment options other than gold (real estate, stock market etc.) rural India has traditionally gravitated towards the yellow metal.

The per gram price gold for the same purity is the same regardless of the form. Gold bars are generally available in larger denominations than gold coins and hence are seen as more expensive. So, when you sell gold bars, you get back the entire value of gold while making charges are deducted in case of gold coins.

China holds 1.7% of reserves in gold, India 10%, Brazil only 0.5%. The Reserve Bank of India holds gold reserves along with currency, and when RBI begins to buy more quantities of gold than it sells, it results in an increase in the gold price. This is due to the increase in cash flow in the market, while there is insufficient supply of gold. As mentioned before, the spot price of gold is decided in the London bullion market. This price is valued in American dollars, euros, and pounds. Henceforth, the value of the Indian rupee influences the price of gold.

For example, in times of economic uncertainty, the demand for gold increases as people are looking to invest in a safe asset class. Currency fluctuations also play a role in determining gold rates in India. Gold is typically priced in US dollars, so when the value of the US dollar falls relative to the Indian rupee, the price of gold in rupee terms increases. Conversely, when the value of the US dollar rises relative to the Indian rupee, the price of gold in rupee terms decreases. This is because gold is a global commodity, and changes in currency values affect the price of gold in different currencies.

The Indian Bullion Jewellers Association has an important role to play in the gold prices of India. IBJA constitutes people who are the biggest dealers of gold in India. These members together have a main role in establishing the gold price in India. These dealers are members of the association and are spread across the country in various states. With flexible exchange rates gold seemed to have lost its status for central banks.

Because the price decrease will increase the demand, and thus gold prices will inflate. That is because when prices rise due to a weak dollar, an inflated gold price might ensure better returns and help mitigate potential investment losses. Also, do note that when we say a weaker dollar we refer it to be weak against the other set of currencies.

The values shown here are indicative as per prevailing rates for 24 karat gold. The gold standard is a system in which a country’s government allows its currency to be freely converted into fixed amounts of gold. Please note that SEBI has restricted us only from acquiring new customers until the matter is resolved. They have given us 21 days to give a comprehensive response to their prima facie findings, and issued an interim order. Most media have reported that we have been banned from trading. There is NO BAN at all whatsoever, except a restriction on onboarding new customers for a twenty-one day period.

I think in investing in gold, but I perceive some ethic issues with it. To buy gold and believe the price will go up it’s almost like to bet in wars, conflicts, deaths, etc. On the other hand, I understand that it’s unavoidable that the price of gold go up, given the majority of countries’ economies are based on Keynesian ideas, so the bubbles gold price depends on which factors in india and busts are always latent. If I’m not mistaken, Mises predicted it, that after of the end of gold standard, the gold price would raise. Most central banks in the developed world are talking down their currencies, so the ECB, SNB, BOJ and finally also the BoE. It seems that the only central bank that might hike rates is the Fed.

Comment (0)